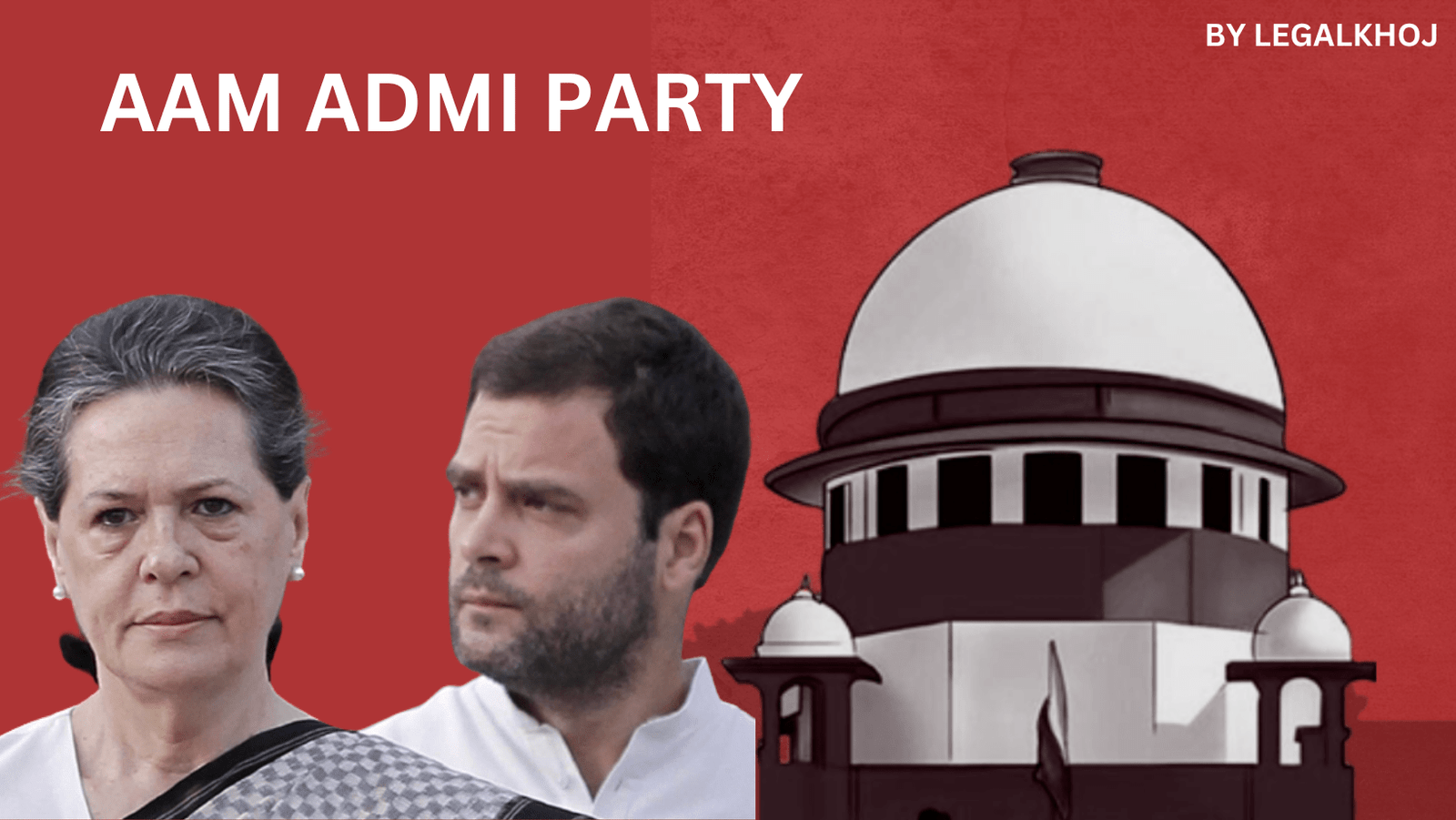

The Supreme Court has adjourned until November 7 the hearing of pleas made by Congress leaders Rahul Gandhi, Sonia Gandhi, Priyanka Gandhi Vadra, the Aam Aadmi Party (AAP), and several charitable trusts challenging the decision of income tax authorities to transfer their tax assessments to the central circle.

The court has also orally directed the respondent authorities not to pass any assessment order in the meantime, after the petitioners accused them of rushing the assessments.

A bench of Justices Sanjiv Khanna and SVN Bhatti heard a series of special leave petitions challenging an order passed by the Delhi High Court in May this year, which upheld the transfer orders.

Senior Advocate Abhishek Manu Singhvi, representing the Aam Aadmi Party, criticized the high court’s observation that even after the introduction of e-assessment and faceless assessment in 2019 and 2020, the jurisdictional assessing officer would continue to exercise concurrent jurisdiction with the faceless assessing officer. Singhvi argued that this has led to overlapping subject matter, contrary to a Central Board of Direct Taxes circular that clearly demarcates the matters that can be dealt with by each. He also pointed out a non-application of mind in this regard.

Singhvi further stated that Section 13A of the Income-tax Act, which deals with political parties, was not mentioned in the transfer order or the high court’s decision, despite the Aam Aadmi Party’s special leave petition being the only one by a political party. He argued that this omission, along with non-compliance with the two-step procedure mandated by law, has deprived the petitioner-party of its vested rights.

Justice Khanna pointed out that they typically interfere only when there is a lack of subject-matter jurisdiction, distinguishing between territorial and subject-matter jurisdictions. He also questioned the political party regarding the five-month delay in filing the petition, noting that such delays can be fatal in cases like this.

The Congress leaders and charitable trusts were represented by Senior Advocate Arvind Datar, who informed the bench that his clients’ cases had been tagged with the assessment of Sanjay Bhandari, who allegedly has links with Robert Vadra, Priyanka Gandhi Vadra’s husband. This tagging occurred even after proceedings under Section 143 had already begun. Datar argued that all these cases were suddenly tagged as supplementary cases due to a search in Sanjay Bhandari’s case.

Justice Khanna suggested that centralised assessment may be required for individuals if there are cross-transactions. However, he questioned why charitable trusts were included in the transfer order. The bench instructed the law officer to clarify whether the assessment officers and the review and verification committees are selected manually, as well as the stage of the current proceedings.

The court also asked the income tax authorities to furnish the original files related to the transfer orders.

The hearing was adjourned after Advocate Zoheb Hossain requested more time on behalf of the Department. During the exchange, Singhvi urged the court to direct the income tax authorities to defer the petitioners’ assessment, stating that the assessments were being rushed. Hossain protested, noting that the challenge to the reassessment notice is being considered by a division bench of the Delhi High Court, which has requested cooperation from the petitioners.

Justice Khanna clarified that they were not passing an interim order but cautioned the respondent authorities not to pass any assessment orders in the meantime. He also inquired about the expiration of limitations, to which Hossain responded that it was in March 2024. The judge noted that there was sufficient time and adjourned the hearing until November 7.

Background:

The controversy in question pertains to the decision of income tax authorities to transfer tax assessments of Congress leaders Rahul Gandhi, Sonia Gandhi, and Priyanka Gandhi Vadra, as well as the Aam Aadmi Party and several charitable trusts, for the assessment year 2018-19 from their respective jurisdictions to the central circle. These transfer orders were issued under Section 127 of the Income Tax Act.

The Delhi High Court upheld these transfer orders, clarifying that the introduction of e-assessment and the faceless assessment scheme did not alter the power to transfer cases from one assessing officer to another, provided they did not have concurrent charges. The petitioners have appealed against this order through special leave petitions.

Case Details:

Aam Aadmi Party v. Commissioner of Income Tax (Exemption) & Ors. | Special Leave Petition (Civil) No. 13038 of 2023.

Supreme Court rejects legalizing same-sex marriage; CJI states court’s role is to enforce, not make, laws.

Leave a Reply